Notice how suddenly the days of corporate grace and goodwill are completely over? No more deep discounts. No more two for ones. Definitely no more free anything.

What happened?

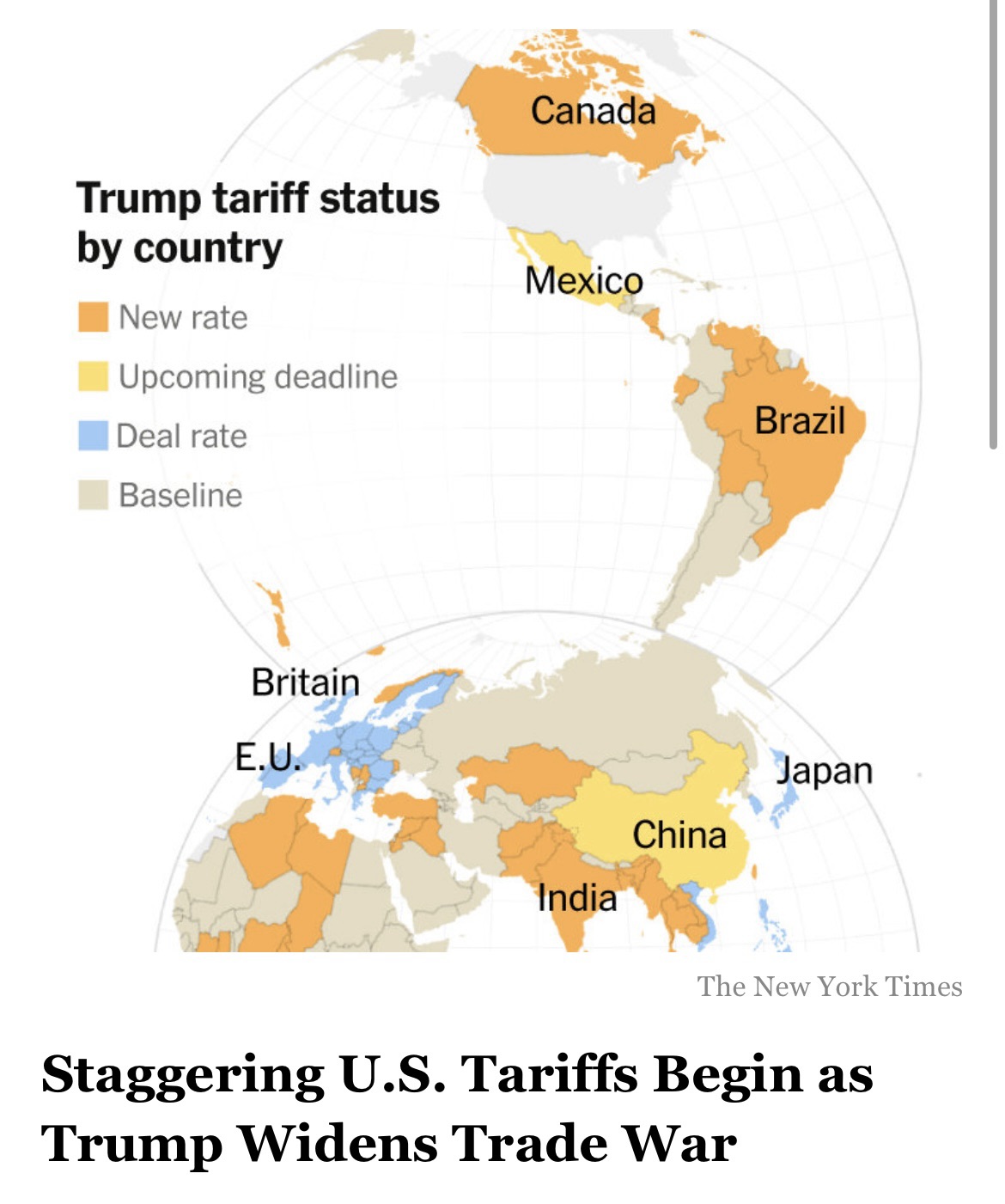

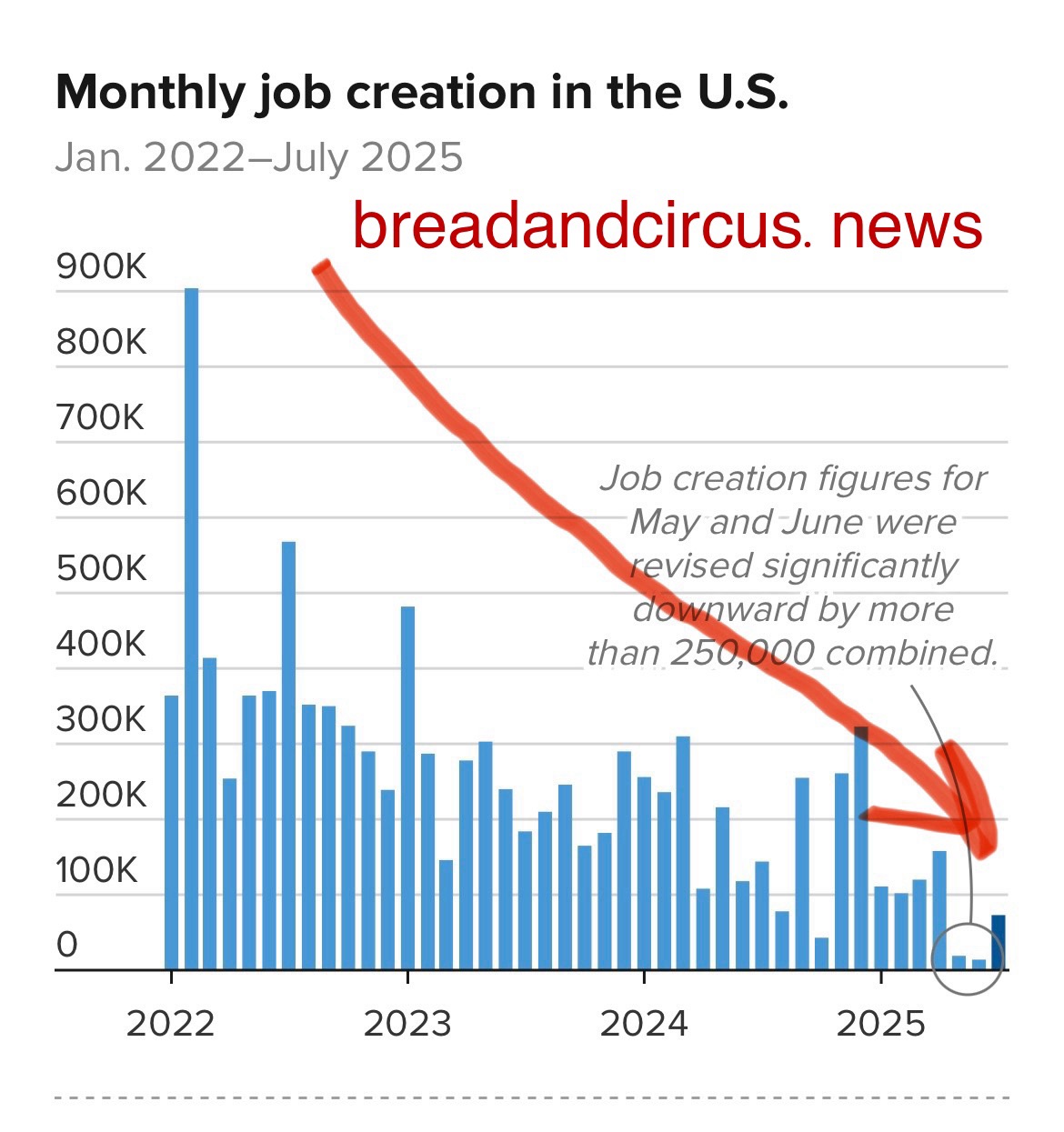

Two things: 1 GREED, the hearts of most have waxed cold; 2 conpanies have razor thin profit margins due to the insane cost of labor, material, and now tariffs, so they are in protectionist mode and pinching every single fraction of a penny they can for absolute maximum profit. Forget “nickel and diming us,” they are literally squeezing us to death.

Moreover, what used to be part of standard service is now considered an “extra.” Case in point. I just signed up for a new cable service. The representative tried to sell me on a bunch of extras. One of them was “tech support.” I asked him what that entailed. He said “if you have technical problems, you can call us and we will help you solve them.”

Huh? Admittedly I was confused by this because tech support has always been included with basic service. But nope. Now they charge $15 per month for you to have the privilege of getting help from them when their cheap and buggy products break. Let that sink in.

Serious question: Do you think this is the golden age for we the people? It’s not.

Let’s get real. The golden age for “us” (meaning the majority of the people) is 100% OVER.

The only reason they (meaning the people in power, and all of their proxies and investors ) are telling us this is the golden age is to keep us wishing on a star so we don’t revolt.

Notice they keep promising but never delivering. The image with this post graphically represents what is happening: They keep promising that the road will be built, and they want us to keep investing money into the road, and they keep telling us how great the road will be, and even posting AI generated images of what it will look like, but they never actually build it.

The truth is, they are selling us vaporware. They are never going to deliver on any of their promises. they will throw us some pretzels and peanuts now in them, but never steak and potatoes. They are simply buying as much time as possible to enrich themselves as much as possible before the total tech takeover is complete.

I know it is tempting to think “at least they are not as bad as the Democrats,” but that is not the truth. They are also corrupt, if not more. The Democrats sold us out to their fav companies and international special interests, the Republicans are selling us out to their fav companies and special interests. Both sides are corrupt, and both sides are not for we the majority of the people.

Also, don’t fall into the trap of thinking just because things are going well for you right now that they will keep going well for you. They (meaning the people in power and all of their proxies and investors ) are executing a multi step TAKEOVER plan. They just haven’t got to you yet. Rest assured, your number is coming soon. There will be no dry staterooms on this sinking ship.

Wake up before it is too late. Oh, and buy my book on Amazon: TOTAL TECH TAKEOVER to see what is coming next if we don’t resist.