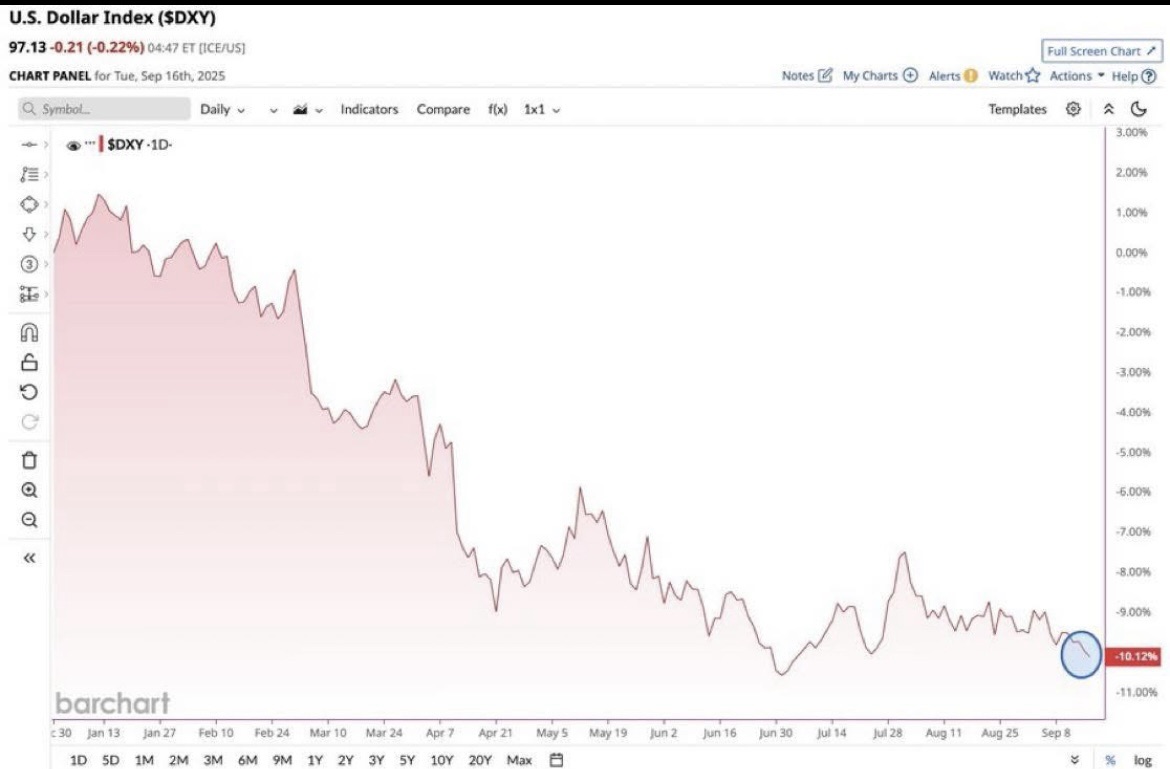

The value of US dollar has tanked 10% since Trump took over. It’s not like he doesn’t have the influence to change that trend, yet he continues to allow it. In the past, he has said he loves it because it allows him to make a lot of money in the stock market. For those of you who don’t know what a devalued dollar does for the lower classes, here’s a primer:

A devalued U.S. dollar generally hits the lower classes the hardest, because they spend a larger share of their income on essentials and have fewer buffers (savings, investments, assets) to protect themselves. Here are the main negative effects:

1. Rising Prices (Inflation)

- When the dollar weakens, imports (food, clothing, fuel, electronics, medicine, etc.) cost more.

- Since the U.S. imports a lot of goods, everyday items become more expensive.

- Lower-income households already spend a higher percentage of their income on basics, so inflation bites them harder.

2. Higher Fuel & Energy Costs

- Oil is priced globally in dollars, so a weaker dollar tends to push up gas and heating prices.

- Transportation and utility bills rise, which trickles down into higher costs for groceries and other necessities.

3. Wage Lag

- Wages for lower-income workers usually don’t keep up with inflation.

- Their purchasing power declines, meaning their paycheck buys less food, rent, and healthcare.

4. Erosion of Savings

- If someone in the lower class manages to save, that money loses value when the dollar weakens.

- Unlike wealthier households, they’re less likely to own assets (like stocks, real estate, or gold) that may rise in value during inflation.

5. Debt Pressure

- Interest rates often rise when inflation picks up.

- Credit cards, car loans, and adjustable-rate mortgages become more expensive, hitting households already living paycheck to paycheck.

6. Reduced Access to Essentials

- Imported medicines, electronics, vehicles, and even some food products become more expensive or scarce.

- This limits choice and can push families toward lower-quality substitutes.

✅ In short: A weaker dollar acts like a hidden tax on the poor — raising costs while giving them no equal upside. Wealthier households may benefit from dollar devaluation if they hold assets, but the working class mostly just sees their cost of living rise.

Would you like me to also break down the few potential benefits a weaker dollar might have for lower-income groups (like more manufacturing jobs), so you see both sides?