EXPOSING THE $1 TRILLION AND COUNTING GREAT AMERICAN HEIST. A massive wealth transfer happened in 2017 (and extended in 2025 through the “big ugly Bill”). Donald Trump gave a massive tax break to corporations and the top 10% earners. Due to his massive handouts, the “free stuff” he gave to the elite class, since 2017 they have collectively pocketed about $1 TRILLION DOLLARS. They didn’t just get more money from Trump — they got several TIMES more.

GET THIS:

For every $10 the elite class pocketed, the average middle-class person got only $2, and a lower income person got $1 or less. WTF??????

So even though everyone technically got a tax cut in 2017, the gap in benefits is massive. It was clearly and without a doubt massive wealth transfer to the upper class that has cost everybody else dearly.

And for those people who are tempted to respond “this is how the economy should work, give the tax breaks to the upper class and they will “trickle down” their profits to the rest of us.” You stand corrected. Don’t even bother. Do some actual research before you weigh in on matters you don’t understand.

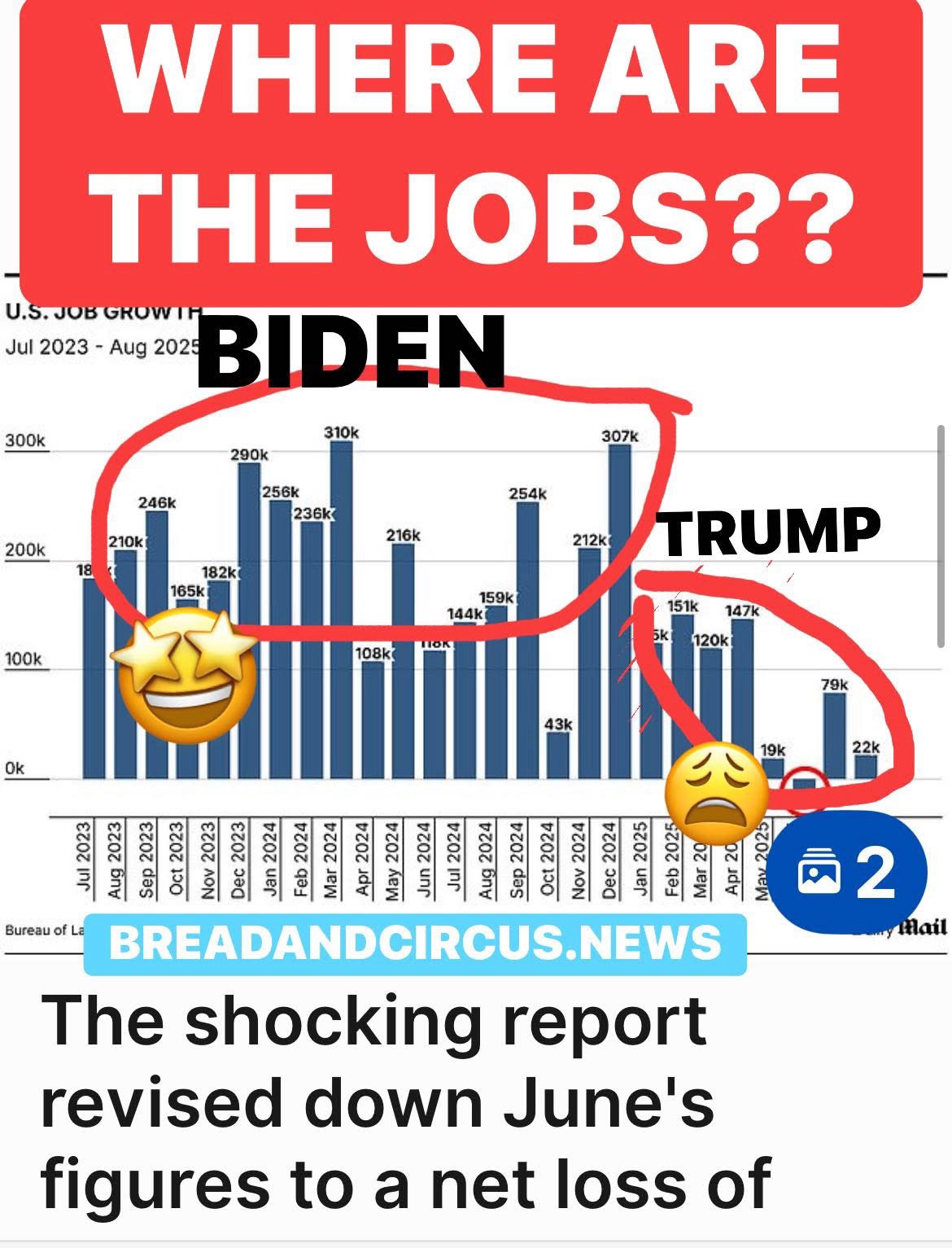

I will do a little research for you. “Trickle down” economics does not work in the age of greed and anarcho capitalism in which companies are no longer held responsible for doing the right thing. If you do the research on this, you will find that the wealthy class did not “trickle down” their savings to anyone. They did not even create more jobs. They actually bought their own stock back. Read that again.

THEY BOUGHT THEIR OWN STOCK BACK.

They also automated more jobs.

They also outsourced more jobs.

They also imported more H1B visa workers with the tax savings so they wouldn’t have to pay American employees full wages

They also bought more homes as investment properties and invested in businesses that only benefited themselves and actually put other businesses out of business.

That’s how unchained GREED works.

Don’t confuse anarcho GREED with American capitalism. They are not the same things. Capitalism without any governance and oversight is not capitalism. It’s theft. Point blank end of story.

The age of “corporate goodwill” never existed. The reason it was ever even a thing is because the government used to hold companies and upper earners accountable and charge them much higher tax rates. Not anymore. Not in the new age of Trumponomics that hands silver and gold to the upper class and throws peanut shells to everyone else (and then throws a fit and accuses them of being ungrateful anti-Americans if they don’t bow down and kiss their feet and thank them for the peanut shells).

(By the way, how did the Republicans trick the people into thinking that this was a good system? They scared them. They told them if they didn’t do this massive wealth transfer that Marxism would take over their country. They tarred and feathered anyone who said they were being greedy and unfair, accusing them of being socialist, communists, an anti-Americans. They were projecting).

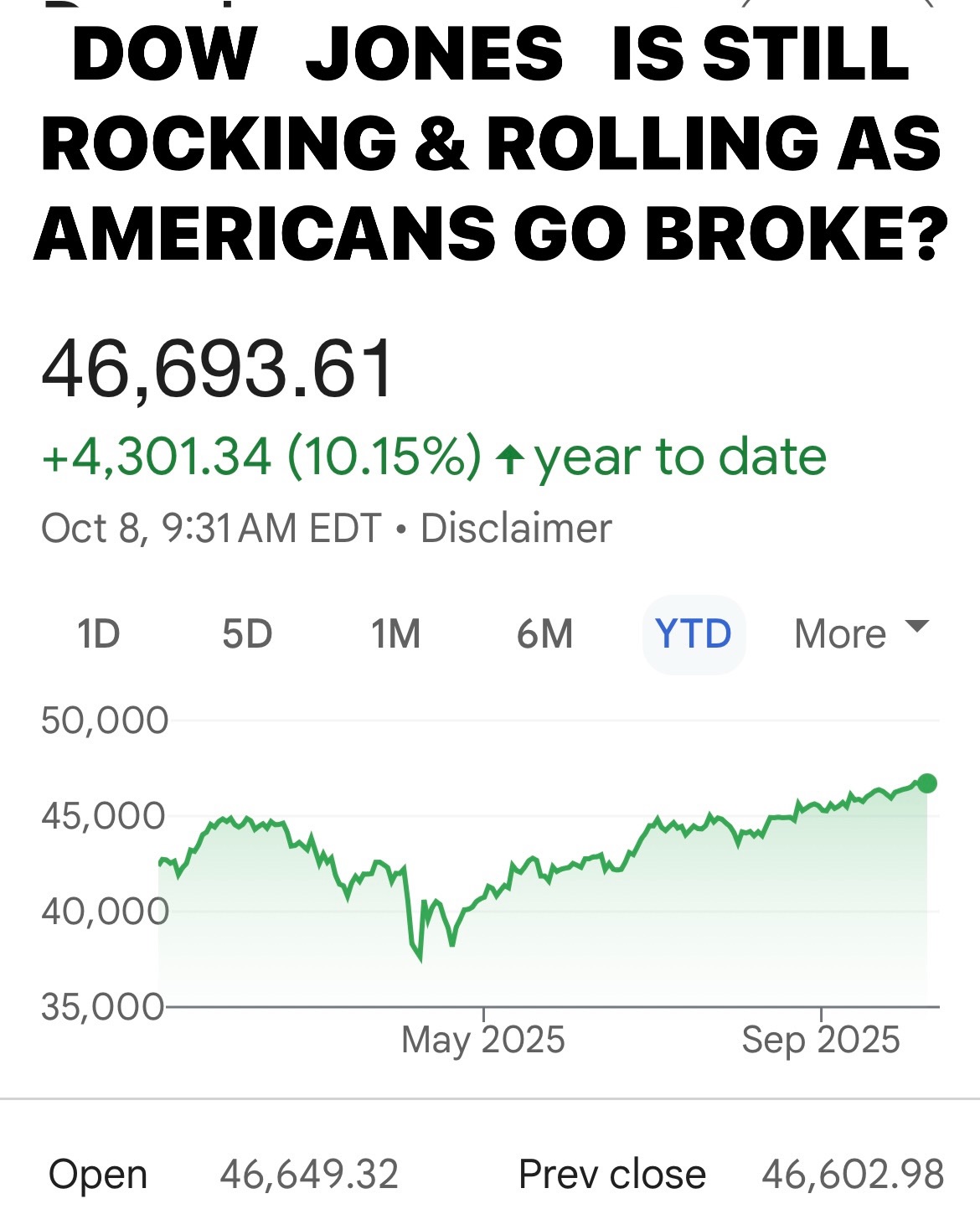

And if you are one of those people whose 401(k)s are “kicking ass,” congratulations. You are reaping the rewards of the corporations in your stock portfolio decreasing their costs through the replacement of your family members’ and neighbors’ jobs with AI and other shrinkflation, etc. methods. “Git it while they’re gittin’s good” as they say. Enjoy the fruits of our labor. but don’t patronize us with some bullshit like “this is how the economy is supposed to work.” We know better. And whatever you do, don’t try to pass it off as sound, just, and ethical economic leadership for the people. We will laugh in your face.

MJ